Headlines broadcasting news of interest rate hikes and rising mortgage rates have been coming at consumers fast and furious for most of 2022

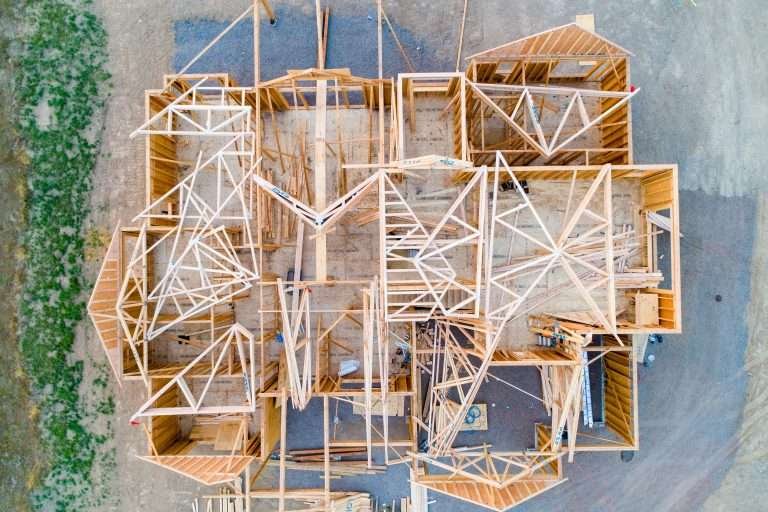

Headlines broadcasting news of interest rate hikes and rising mortgage rates have been coming at consumers fast and furious for most of 2022. And there’s no question the housing market has seen a deceleration as a result of that economic equation. But for home buyers seeking out deals or looking to protect themselves against inflation, now may be the perfect time to take the leap, especially for those who have their heart set on new construction.

The slowdown is affecting all property types and locations differently and new developments are no exception. While inventory has been historically low within the vertical, pre and new construction have still felt the impact of a slowing market, creating wiggle room in list prices. An additional benefit of investing in a development still under construction is that developers are usually incentivized to sell a certain percentage of units quickly in order to meet financial requirements.

Some may not have the fortitude for such a big purchase that is largely incomplete, but Cyndy Salgado, executive vice president of development sales for @properties Development Group, believes the risk is minimal and the rewards – especially now – are countless.

“While not all buyers feel comfortable purchasing a pre-construction home sight unseen, a buyer who can come to the table with a vision for what that space will ultimately deliver stands to overcome any feared disadvantages with the chance to choose the best unit at the most competitive price,” said Salgado.

Despite the recent decrease in demand, inventory has still not caught up to pre-pandemic levels, keeping new construction prices somewhat stable. However, developers are typically willing to negotiate on pre-construction whether for a lower contract price after a development has just been released, or for upgrades, and even closing costs.

Investors who aren’t on a tight timetable are also at an advantage when considering a new development. “Our pre-construction buyers often have a lot of flexibility in their lives and aren’t as impacted by delivery dates,” said David Tufts, partner with @properties Development Group. Tufts added that a new development is a great opportunity for individuals that have the discretionary income for a second home that they don’t need to move into right away.

Pre-construction can also serve to protect your money, as hard assets like real estate are still very much in favor because they offer a hedge against inflation. The investment will become more valuable over time, increasing in equity as the monthly payment stays the same. Home appreciation is affected by a variety of factors including market conditions and location, but currently, the national average appreciation rate is 2% month over month and 14.5% year over year.

For information on a variety of premier new construction developments within Illinois, Wisconsin, Indiana and Georgia, visit @properties Development Group.